Before Getting Started make sure you got pip and python 3.8 or higher

I am using a Jupyter Notebook and I might already have these libraries but going to run it just in case

1

| pip install pandas numpy matplotlib yfinance seaborn

|

These are the following companies we are going to use for analyzing:

San Miguel Corporation (SMGBF)

Jollibee Foods Corporation (JBFCY)

Universal Robina Corporation (UVRBF)

Mondelez International, Inc.(MDLZ)

yfinance is a library for fetching historical stock data

pandas for Data Exploration and Data Cleaning

seaborn and matplotlib for Data Visualization (Honestly when I heard about these in 2016 or 17 I thought these were YouTubers)

1

2

3

4

| #pandas and NumPy imports

import pandas as pd

from pandas import Series,DataFrame

import numpy as np

|

1

2

3

4

5

| # For Visualization

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

%matplotlib inline

|

1

2

3

4

| import os #for files read/write

from datetime import datetime # For time stamps

import yfinance as yf #fetching the data stock

from __future__ import division# For division in Python 3

|

1

2

3

4

5

6

7

8

| # Fetch stock data

def fetch_stock_data(ticker, start_date, end_date):

stock_data = yf.download(ticker, start=start_date, end=end_date)

return stock_data

smg_data = fetch_stock_data('SMGBF', '2021-01-01', '2023-12-31')

jbf_data = fetch_stock_data('JBFCY', '2021-01-01', '2023-12-31')

uvr_data = fetch_stock_data('UVRBF', '2021-01-01', '2023-12-31')

delm_data = fetch_stock_data('MDLZ', '2021-01-01', '2023-12-31')

|

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

checking data

1

2

3

4

| print(smg_data.head())

print(jbf_data.head())

print(uvr_data.head())

print(delm_data.head())

|

Price Close High Low Open Volume

Ticker SMGBF SMGBF SMGBF SMGBF SMGBF

Date

2021-01-04 2.550820 2.550820 2.550820 2.550820 0

2021-01-05 2.479167 2.479167 2.479167 2.479167 1100

2021-01-06 2.479167 2.479167 2.479167 2.479167 0

2021-01-07 2.479167 2.479167 2.479167 2.479167 0

2021-01-08 2.479167 2.479167 2.479167 2.479167 0

Price Close High Low Open Volume

Ticker JBFCY JBFCY JBFCY JBFCY JBFCY

Date

2021-01-04 15.941961 15.941961 15.941961 15.941961 500

2021-01-05 15.941961 15.941961 15.941961 15.941961 0

2021-01-06 15.941961 15.941961 15.941961 15.941961 0

2021-01-07 14.946193 15.139546 14.946193 14.946193 1100

2021-01-08 14.946193 14.946193 14.946193 14.946193 0

Price Close High Low Open Volume

Ticker UVRBF UVRBF UVRBF UVRBF UVRBF

Date

2021-01-04 2.765748 2.765748 2.765748 2.765748 0

2021-01-05 2.765748 2.765748 2.765748 2.765748 0

2021-01-06 2.765748 2.765748 2.765748 2.765748 0

2021-01-07 2.765748 2.765748 2.765748 2.765748 0

2021-01-08 2.844769 2.844769 2.844769 2.844769 5000

Price Close High Low Open Volume

Ticker MDLZ MDLZ MDLZ MDLZ MDLZ

Date

2021-01-04 52.686432 54.578488 52.149747 53.204931 9187200

2021-01-05 52.741009 52.868358 52.140646 52.659141 5421900

2021-01-06 52.640957 53.059395 52.449933 52.750116 7663200

2021-01-07 52.540890 53.077578 52.167937 52.504507 8589100

2021-01-08 52.932041 53.004814 52.149752 52.186135 6642700

checking for dupes

1

2

3

4

| print(smg_data.isnull().sum())

print(jbf_data.isnull().sum())

print(uvr_data.isnull().sum())

print(delm_data.isnull().sum())

|

1

| type(smg_data) #I just like to check what type of data we are working with

|

checking excel file

1

2

3

| path = 'fnbStocks.xlsx'

isExist = os.path.exists(path)

print(isExist)

|

True

So there was an error making the excel and here you would see that the columns for our data frame has two values

| Price | Close | High | Low | Open | Volume |

|---|

| Ticker | SMGBF | SMGBF | SMGBF | SMGBF | SMGBF |

|---|

| Date | | | | | |

|---|

| 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

|---|

| 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

|---|

| 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| ... | ... | ... | ... | ... | ... |

|---|

| 2023-12-22 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

|---|

| 2023-12-26 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

|---|

| 2023-12-27 | 1.880809 | 1.969900 | 1.880809 | 1.969900 | 3000 |

|---|

| 2023-12-28 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

|---|

| 2023-12-29 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

|---|

753 rows × 5 columns

1

| display(smg_data.columns)

|

MultiIndex([( 'Close', 'SMGBF'),

( 'High', 'SMGBF'),

( 'Low', 'SMGBF'),

( 'Open', 'SMGBF'),

('Volume', 'SMGBF')],

names=['Price', 'Ticker'])

reassigned every dataframe with a new column

1

2

3

4

| smg_data.columns= [col[0] for col in smg_data.columns]

jbf_data.columns=[col[0] for col in jbf_data.columns]

uvr_data.columns=[col[0] for col in uvr_data.columns]

delm_data.columns=[col[0] for col in delm_data.columns]

|

1

| display(smg_data.columns)

|

Index(['Close', 'High', 'Low', 'Open', 'Volume'], dtype='object')

| Close | High | Low | Open | Volume |

|---|

| Date | | | | | |

|---|

| 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

|---|

| 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

|---|

| 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| ... | ... | ... | ... | ... | ... |

|---|

| 2023-12-22 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

|---|

| 2023-12-26 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

|---|

| 2023-12-27 | 1.880809 | 1.969900 | 1.880809 | 1.969900 | 3000 |

|---|

| 2023-12-28 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

|---|

| 2023-12-29 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

|---|

753 rows × 5 columns

1

2

3

4

5

| with pd.ExcelWriter('fnbStocks.xlsx') as writer:

smg_data.to_excel(writer, sheet_name='SanMiguel')

jbf_data.to_excel(writer, sheet_name='Jollibee')

uvr_data.to_excel(writer, sheet_name='Robina')

delm_data.to_excel(writer, sheet_name='DelMonte')

|

check to see if your excel file is good.

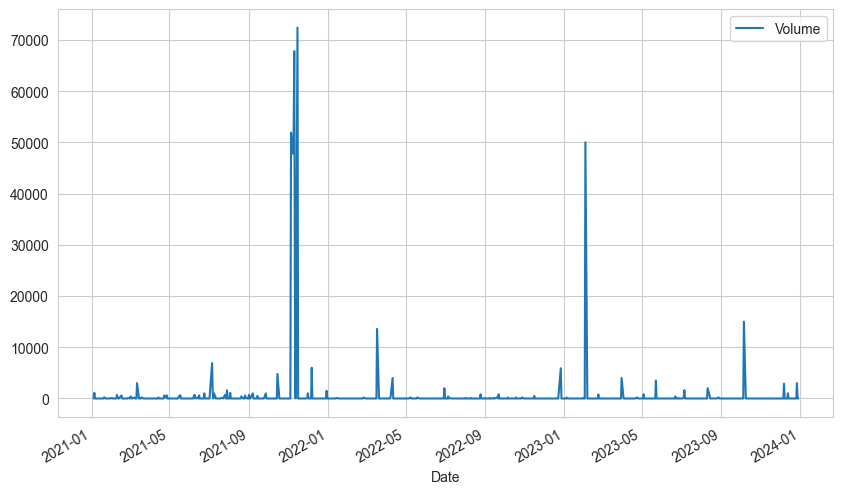

1

2

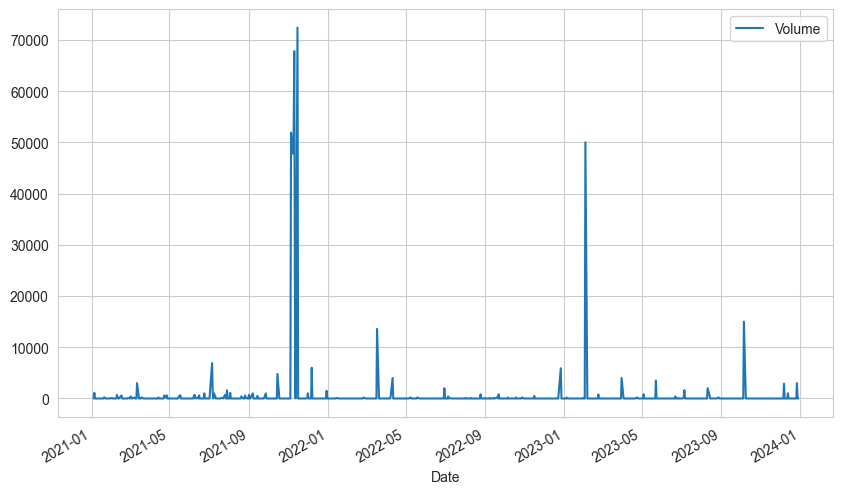

| smg_data['Volume'].plot(legend=True,figsize=(10,6))

#historical view of volume for San Miguel Corp

|

<Axes: xlabel='Date'>

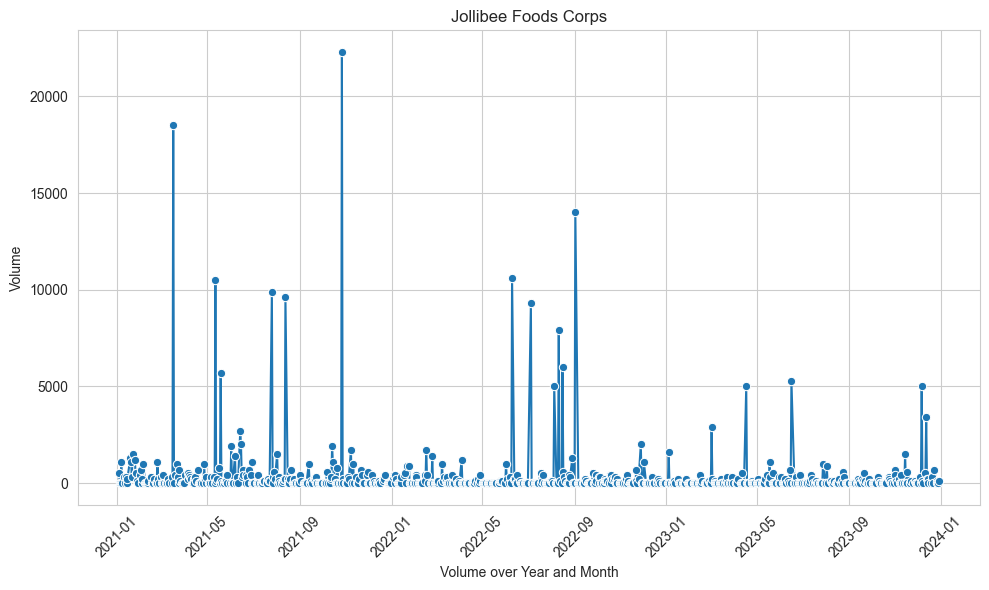

Pivot a table from datetime

1

2

3

4

5

6

7

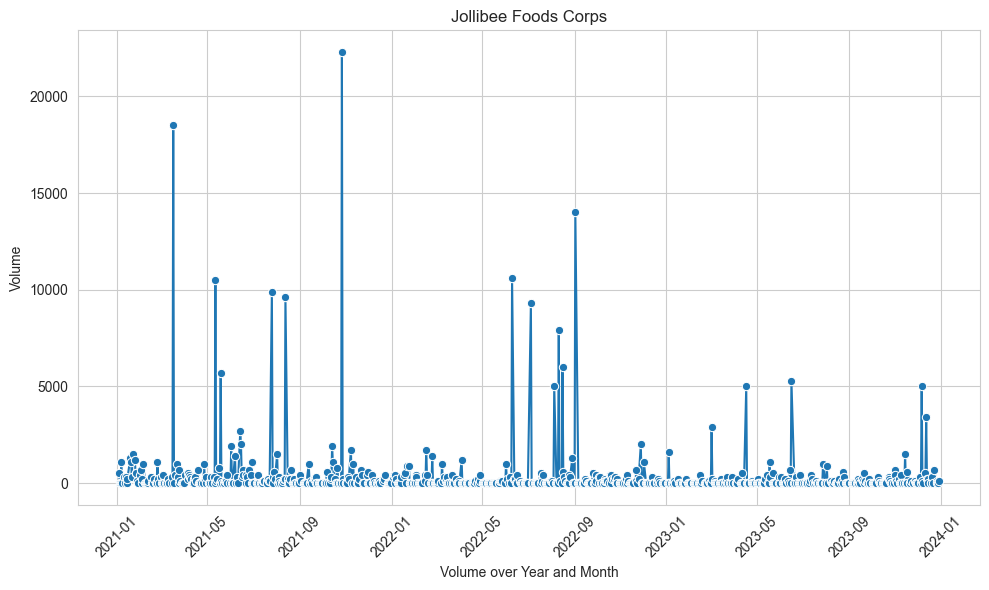

| plt.figure(figsize=(10, 6))

sns.lineplot(x='Date', y='Volume', data=jbf_data, marker='o')

plt.xticks(rotation=45)

plt.title('Jollibee Foods Corps')

plt.xlabel('Volume over Year and Month')

plt.tight_layout()

plt.show()

|

historical view of volume for Jollibee

| Close | High | Low | Open | Volume |

|---|

| Date | | | | | |

|---|

| 2021-01-04 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 2021-01-05 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 2021-01-06 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 2021-01-07 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 2021-01-08 | 2.844769 | 2.844769 | 2.844769 | 2.844769 | 5000 |

|---|

| ... | ... | ... | ... | ... | ... |

|---|

| 2023-12-22 | 1.870327 | 1.870327 | 1.870327 | 1.870327 | 0 |

|---|

| 2023-12-26 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 7600 |

|---|

| 2023-12-27 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

|---|

| 2023-12-28 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

|---|

| 2023-12-29 | 1.927875 | 1.927875 | 1.927875 | 1.927875 | 2500 |

|---|

753 rows × 5 columns

1

2

3

| # Convert 'date_column' to datetime format

uvr_data = uvr_data.reset_index(drop=False)

display(uvr_data)

|

| Date | Close | High | Low | Open | Volume |

|---|

| 0 | 2021-01-04 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 1 | 2021-01-05 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 2 | 2021-01-06 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 3 | 2021-01-07 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

|---|

| 4 | 2021-01-08 | 2.844769 | 2.844769 | 2.844769 | 2.844769 | 5000 |

|---|

| ... | ... | ... | ... | ... | ... | ... |

|---|

| 748 | 2023-12-22 | 1.870327 | 1.870327 | 1.870327 | 1.870327 | 0 |

|---|

| 749 | 2023-12-26 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 7600 |

|---|

| 750 | 2023-12-27 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

|---|

| 751 | 2023-12-28 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

|---|

| 752 | 2023-12-29 | 1.927875 | 1.927875 | 1.927875 | 1.927875 | 2500 |

|---|

753 rows × 6 columns

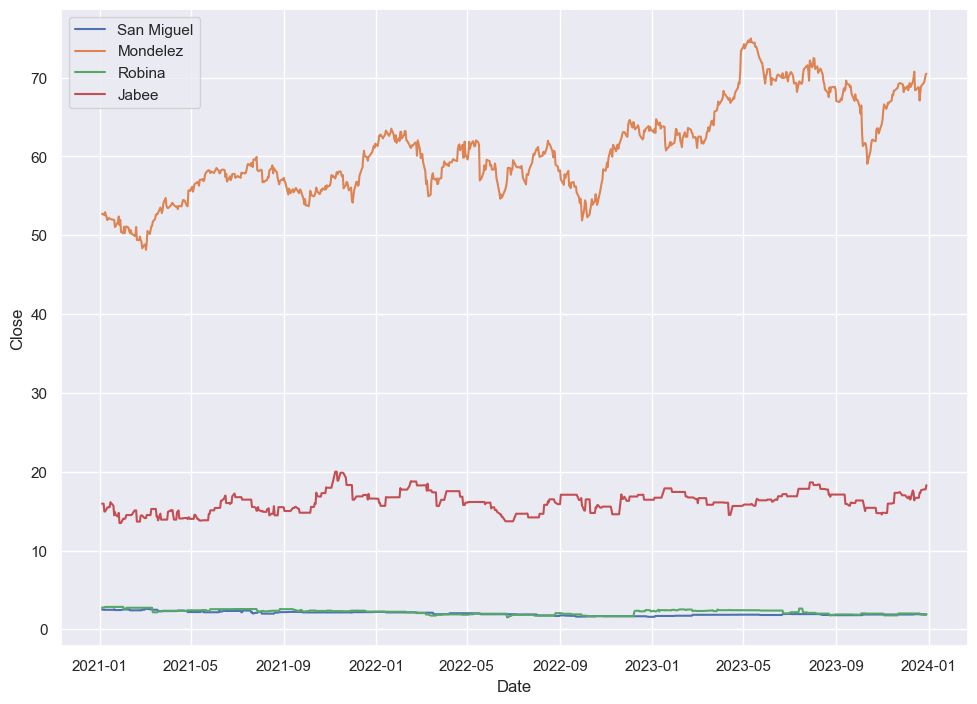

1

2

3

4

5

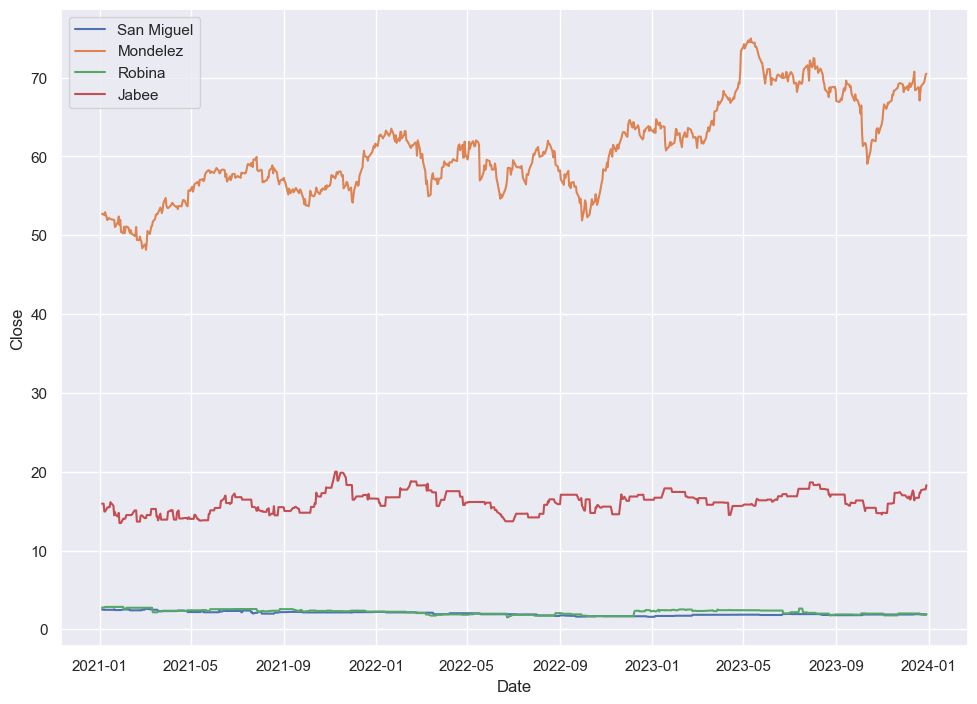

| sns.set_theme(rc={'figure.figsize':(11.7,8.27)})

sns.lineplot(data=smg_data, x='Date', y='Close', label='San Miguel')

sns.lineplot(data=delm_data, x='Date', y='Close', label='Mondelez')

sns.lineplot(data=uvr_data, x='Date', y='Close', label='Robina')

sns.lineplot(data=jbf_data, x='Date', y='Close', label='Jabee')

|

<Axes: xlabel='Date', ylabel='Close'>

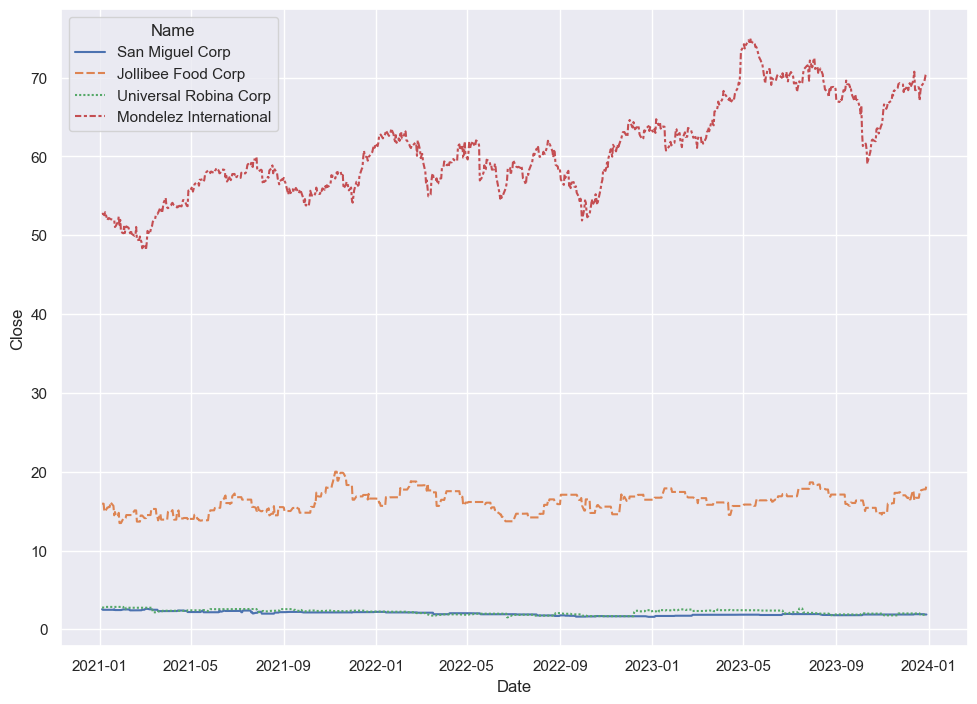

historical comparison of Closing price of Stocks

1

2

3

| smg_data = smg_data.reset_index(drop=False)

jbf_data = jbf_data.reset_index(drop=False)

delm_data = delm_data.reset_index(drop=False)

|

1

2

3

4

5

| smg_data.insert(0, 'Name', 'San Miguel Corp')

jbf_data.insert(0, 'Name', 'Jollibee Food Corp')

delm_data.insert(0, 'Name', 'Mondelez International')

uvr_data.insert(0, 'Name', 'Universal Robina Corp')

#adding a columns Name in the data frame

|

1

2

3

4

| # The comp stocks we'll use for this analysis

comp_list = [smg_data,jbf_data,uvr_data,delm_data]

#merging all the companies

comp_listGlobal = pd.concat(comp_list)

|

1

| display(comp_listGlobal)

|

| Name | Date | Close | High | Low | Open | Volume |

|---|

| 0 | San Miguel Corp | 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

|---|

| 1 | San Miguel Corp | 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

|---|

| 2 | San Miguel Corp | 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 3 | San Miguel Corp | 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| 4 | San Miguel Corp | 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

|---|

| ... | ... | ... | ... | ... | ... | ... | ... |

|---|

| 748 | Mondelez International | 2023-12-22 | 68.921280 | 69.269710 | 68.476065 | 68.553496 | 4109000 |

|---|

| 749 | Mondelez International | 2023-12-26 | 69.405212 | 69.589108 | 68.718033 | 68.911602 | 4002900 |

|---|

| 750 | Mondelez International | 2023-12-27 | 69.889145 | 69.937541 | 69.240681 | 69.463284 | 4061500 |

|---|

| 751 | Mondelez International | 2023-12-28 | 70.351608 | 70.439228 | 69.796662 | 69.884282 | 4095300 |

|---|

| 752 | Mondelez International | 2023-12-29 | 70.517113 | 70.731304 | 70.205564 | 70.234771 | 4658600 |

|---|

3012 rows × 7 columns

1

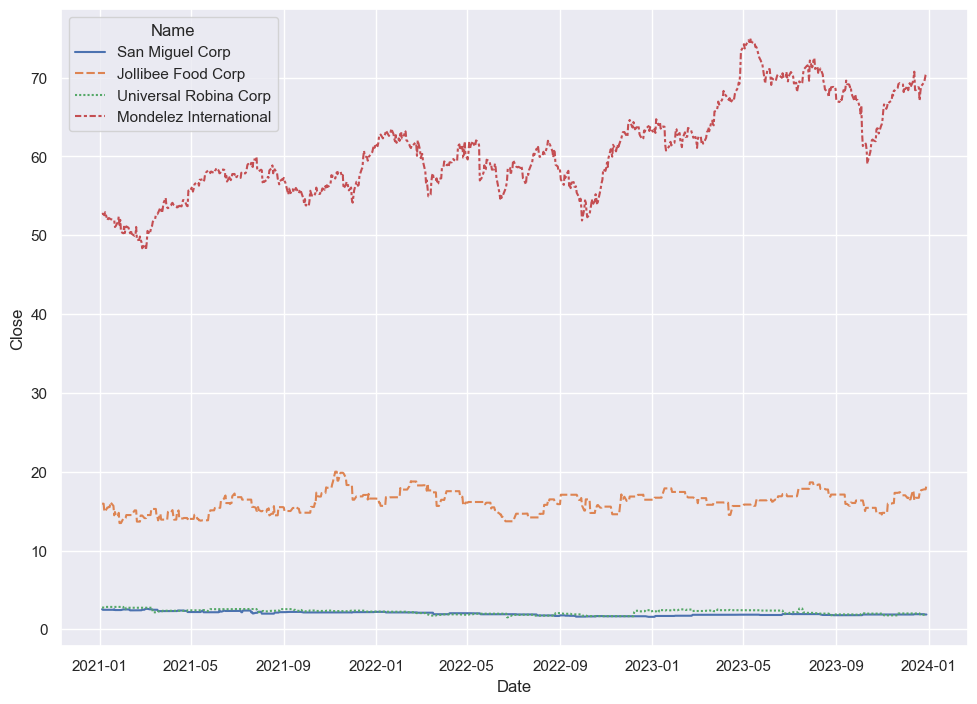

| sns.lineplot(data=comp_listGlobal,x="Date", y="Close", hue="Name", style="Name")

|

<Axes: xlabel='Date', ylabel='Close'>

This is a much simple code of historical comparison of Closing price of Stocks

1

2

3

| #pivot a new data frame here

CloseDF = comp_listGlobal.pivot(index='Date', columns='Name', values=['Close'])

display(CloseDF)

|

| Close |

|---|

| Name | Jollibee Food Corp | Mondelez International | San Miguel Corp | Universal Robina Corp |

|---|

| Date | | | | |

|---|

| 2021-01-04 | 15.941961 | 52.686432 | 2.550820 | 2.765748 |

|---|

| 2021-01-05 | 15.941961 | 52.741009 | 2.479167 | 2.765748 |

|---|

| 2021-01-06 | 15.941961 | 52.640957 | 2.479167 | 2.765748 |

|---|

| 2021-01-07 | 14.946193 | 52.540890 | 2.479167 | 2.765748 |

|---|

| 2021-01-08 | 14.946193 | 52.932041 | 2.479167 | 2.844769 |

|---|

| ... | ... | ... | ... | ... |

|---|

| 2023-12-22 | 17.654762 | 68.921280 | 1.920405 | 1.870327 |

|---|

| 2023-12-26 | 17.764172 | 69.405212 | 1.920405 | 1.831961 |

|---|

| 2023-12-27 | 17.764172 | 69.889145 | 1.880809 | 1.831961 |

|---|

| 2023-12-28 | 17.764172 | 70.351608 | 1.880809 | 1.831961 |

|---|

| 2023-12-29 | 18.291327 | 70.517113 | 1.880809 | 1.927875 |

|---|

753 rows × 4 columns

1

2

| # Calculate the daily return percent of all stocks and store them

comp_returns = CloseDF.pct_change()

|

| Close |

|---|

| Name | Jollibee Food Corp | Mondelez International | San Miguel Corp | Universal Robina Corp |

|---|

| Date | | | | |

|---|

| 2021-01-04 | NaN | NaN | NaN | NaN |

|---|

| 2021-01-05 | 0.000000 | 0.001036 | -0.028090 | 0.000000 |

|---|

| 2021-01-06 | 0.000000 | -0.001897 | 0.000000 | 0.000000 |

|---|

| 2021-01-07 | -0.062462 | -0.001901 | 0.000000 | 0.000000 |

|---|

| 2021-01-08 | 0.000000 | 0.007445 | 0.000000 | 0.028571 |

|---|

| ... | ... | ... | ... | ... |

|---|

| 2023-12-22 | 0.018944 | 0.010644 | 0.000000 | 0.000000 |

|---|

| 2023-12-26 | 0.006197 | 0.007022 | 0.000000 | -0.020513 |

|---|

| 2023-12-27 | 0.000000 | 0.006973 | -0.020619 | 0.000000 |

|---|

| 2023-12-28 | 0.000000 | 0.006617 | 0.000000 | 0.000000 |

|---|

| 2023-12-29 | 0.029675 | 0.002353 | 0.000000 | 0.052356 |

|---|

753 rows × 4 columns

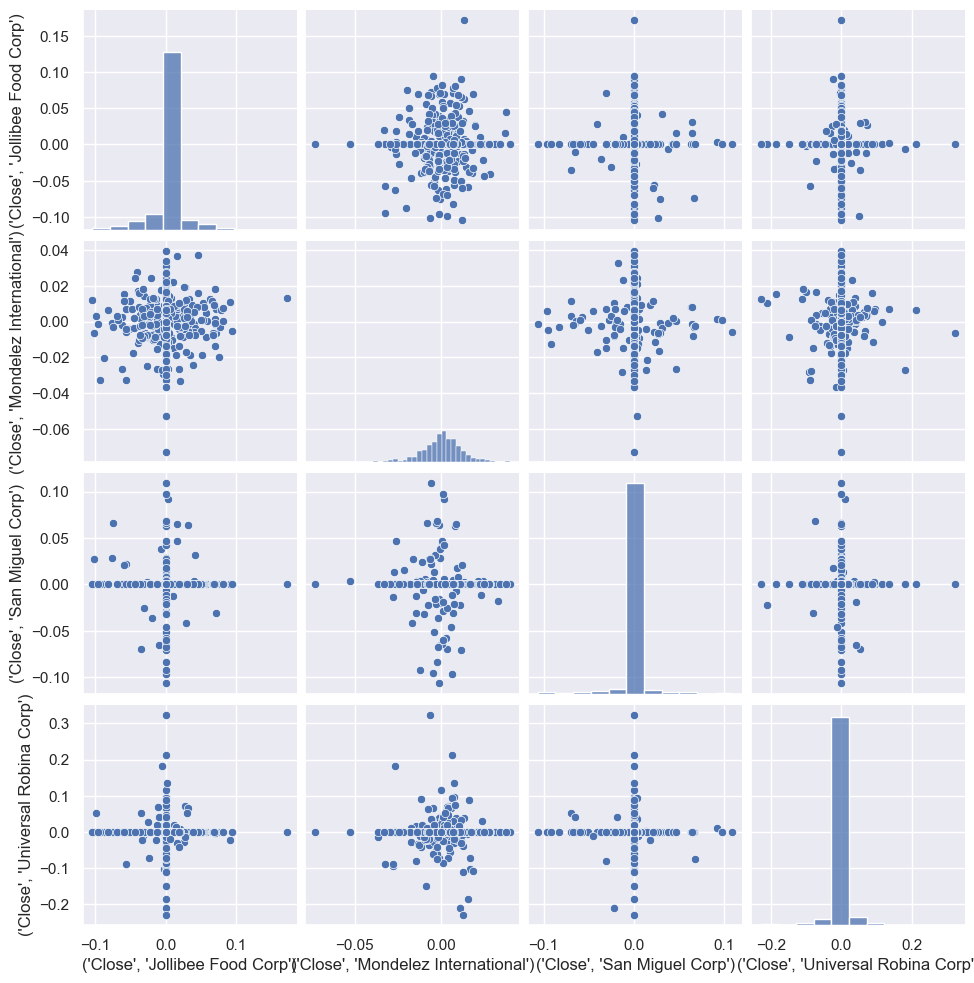

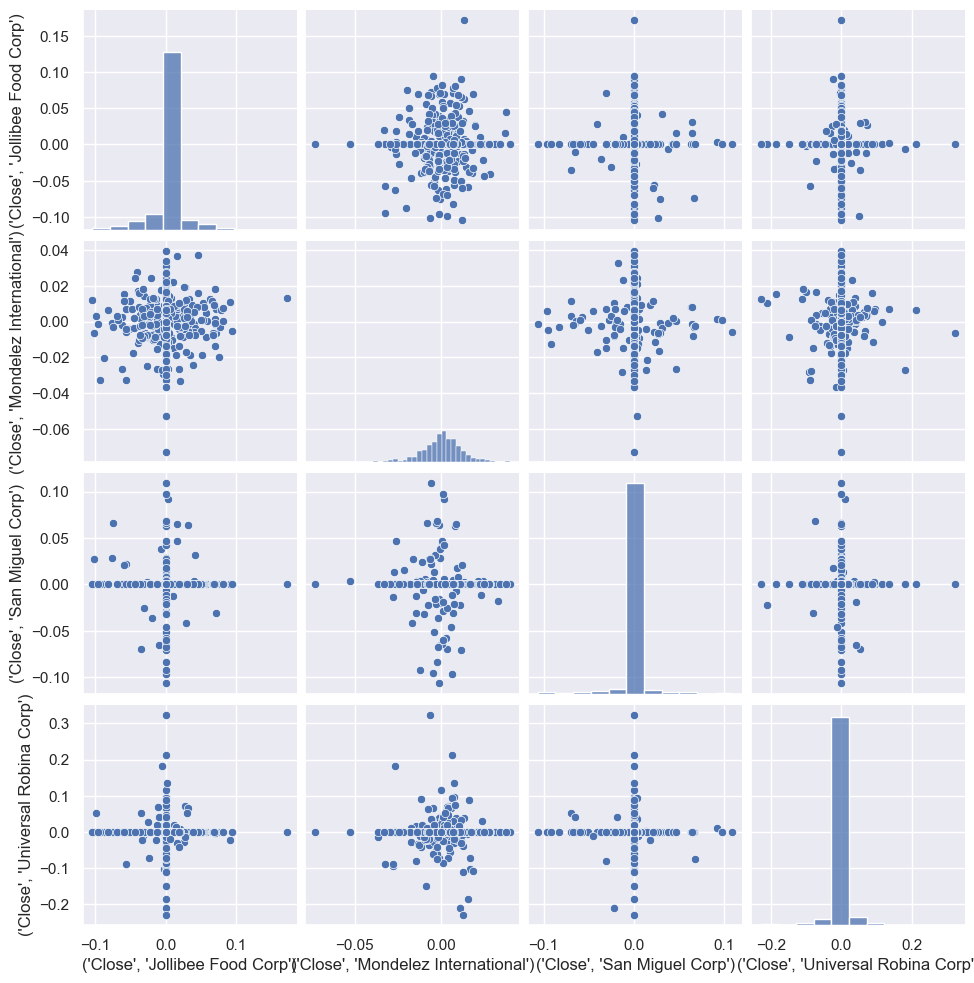

1

2

| sns.pairplot(comp_returns.dropna())

#correlation analysis for all possible pairs of stocks in our food stock ticker list.

|

<seaborn.axisgrid.PairGrid at 0x1e5652c4500>

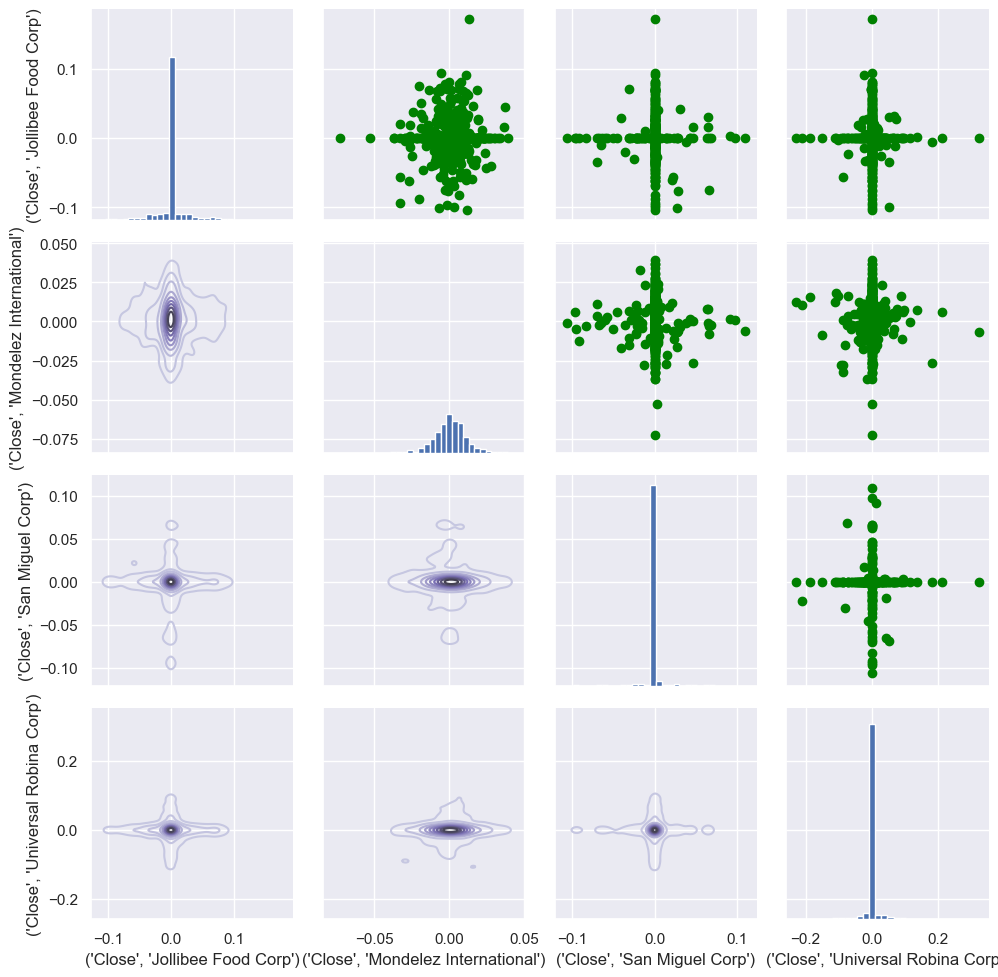

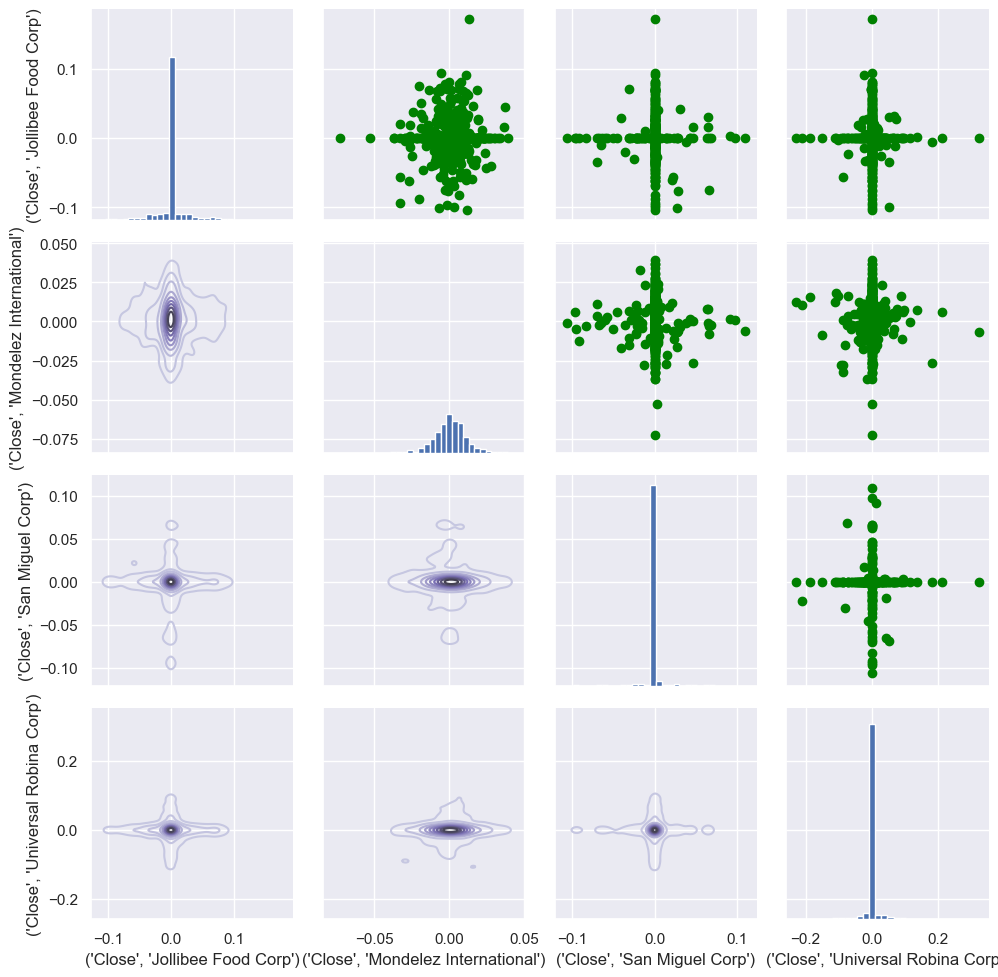

1

2

3

4

5

| # Mixed plot to visualize the correlation between all food stocks

comp_fig = sns.PairGrid(comp_returns.dropna())

comp_fig.map_upper(plt.scatter,color='green')

comp_fig.map_lower(sns.kdeplot,cmap='Purples_d')

comp_fig.map_diag(plt.hist,bins=30)

|

<seaborn.axisgrid.PairGrid at 0x1e56934adb0>

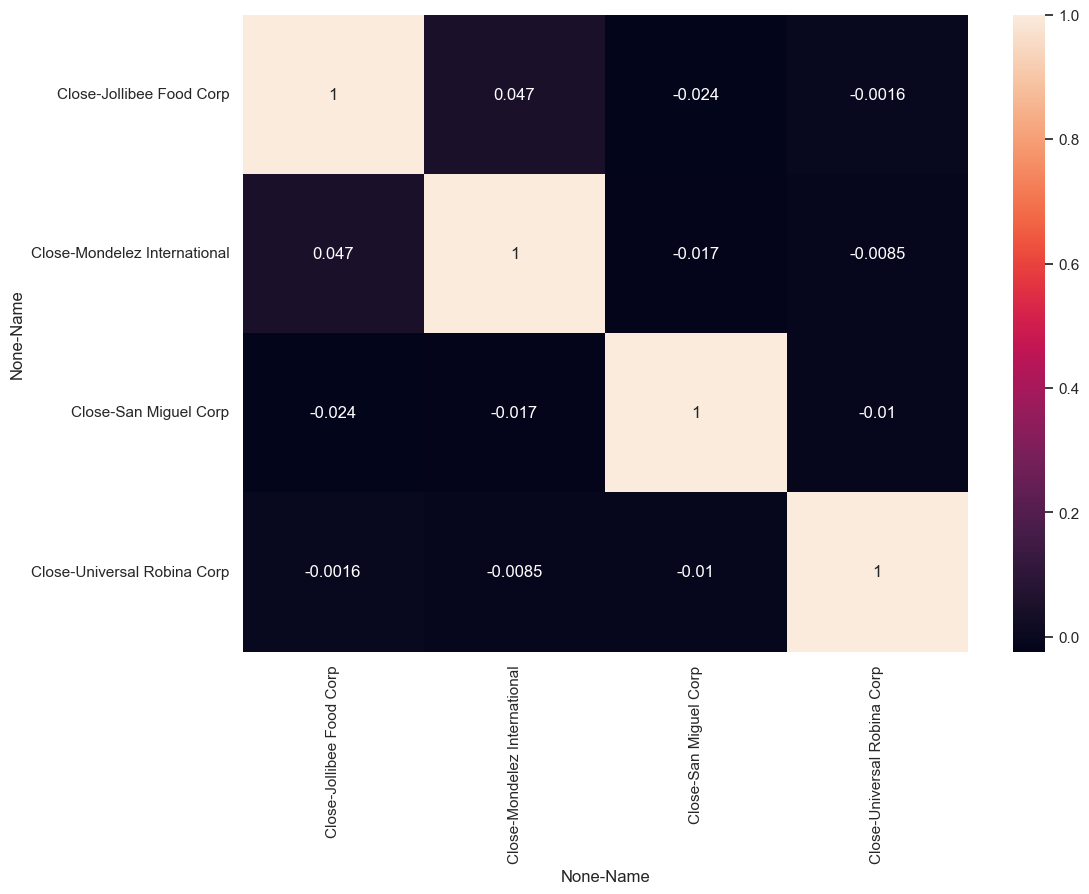

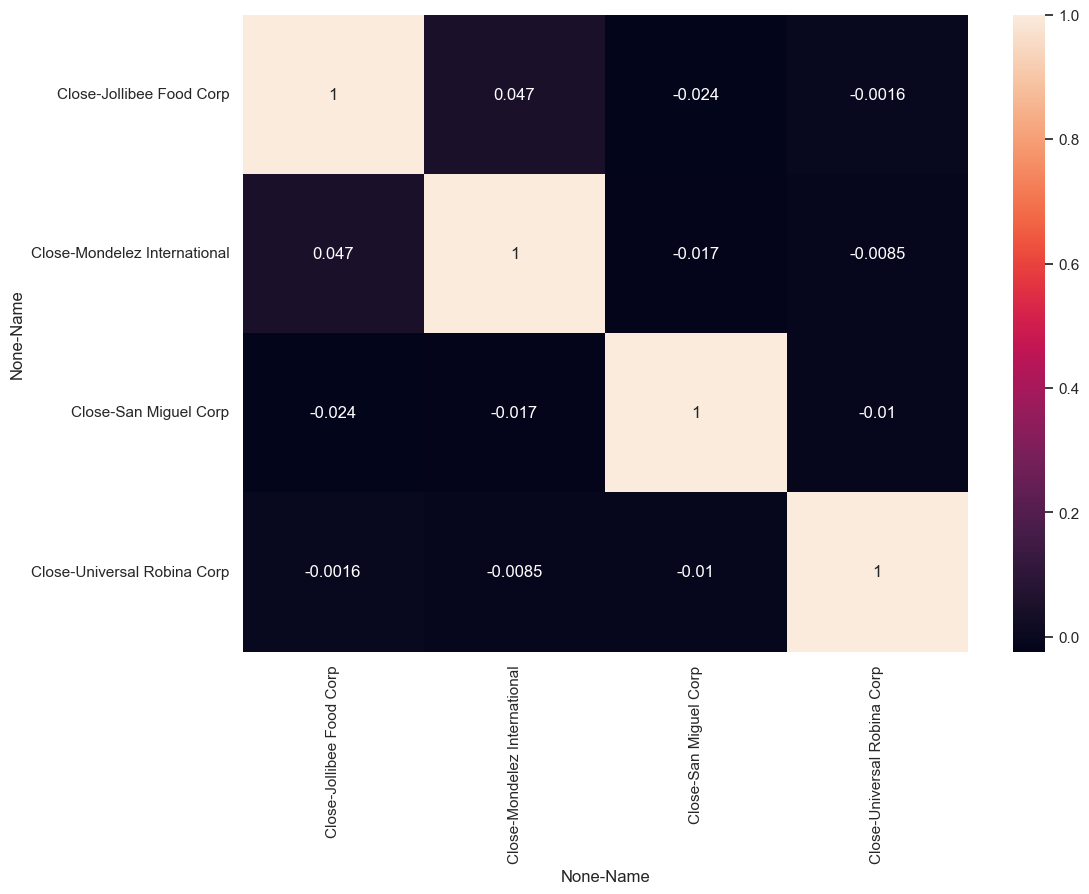

1

2

3

| # Correlation plot for the daily returns of all stocks

comp_returns_corr= comp_returns.dropna().corr()

sns.heatmap(comp_returns_corr,annot=True)

|

<Axes: xlabel='None-Name', ylabel='None-Name'>