Before Getting Started make sure you got pip and python 3.8 or higher

I am using a Jupyter Notebook and I might already have these libraries but going to run it just in case

pip install pandas numpy matplotlib yfinance seabornThese are the following companies we are going to use for analyzing: San Miguel Corporation (SMGBF) Jollibee Foods Corporation (JBFCY) Universal Robina Corporation (UVRBF) Mondelez International, Inc.(MDLZ)

yfinance is a library for fetching historical stock data

pandas for Data Exploration and Data Cleaning

seaborn and matplotlib for Data Visualization (Honestly when I heard about these in 2016 or 17 I thought these were YouTubers)

#pandas and NumPy imports

import pandas as pd

from pandas import Series,DataFrame

import numpy as np# For Visualization

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

%matplotlib inlineimport os #for files read/write

from datetime import datetime # For time stamps

import yfinance as yf #fetching the data stock

from __future__ import division# For division in Python 3# Fetch stock data

def fetch_stock_data(ticker, start_date, end_date):

stock_data = yf.download(ticker, start=start_date, end=end_date)

return stock_data

smg_data = fetch_stock_data('SMGBF', '2021-01-01', '2023-12-31')

jbf_data = fetch_stock_data('JBFCY', '2021-01-01', '2023-12-31')

uvr_data = fetch_stock_data('UVRBF', '2021-01-01', '2023-12-31')

delm_data = fetch_stock_data('MDLZ', '2021-01-01', '2023-12-31')[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

checking data

print(smg_data.head())

print(jbf_data.head())

print(uvr_data.head())

print(delm_data.head())Price Close High Low Open Volume

Ticker SMGBF SMGBF SMGBF SMGBF SMGBF

Date

2021-01-04 2.550820 2.550820 2.550820 2.550820 0

2021-01-05 2.479167 2.479167 2.479167 2.479167 1100

2021-01-06 2.479167 2.479167 2.479167 2.479167 0

2021-01-07 2.479167 2.479167 2.479167 2.479167 0

2021-01-08 2.479167 2.479167 2.479167 2.479167 0

Price Close High Low Open Volume

Ticker JBFCY JBFCY JBFCY JBFCY JBFCY

Date

2021-01-04 15.941961 15.941961 15.941961 15.941961 500

2021-01-05 15.941961 15.941961 15.941961 15.941961 0

2021-01-06 15.941961 15.941961 15.941961 15.941961 0

2021-01-07 14.946193 15.139546 14.946193 14.946193 1100

2021-01-08 14.946193 14.946193 14.946193 14.946193 0

Price Close High Low Open Volume

Ticker UVRBF UVRBF UVRBF UVRBF UVRBF

Date

2021-01-04 2.765748 2.765748 2.765748 2.765748 0

2021-01-05 2.765748 2.765748 2.765748 2.765748 0

2021-01-06 2.765748 2.765748 2.765748 2.765748 0

2021-01-07 2.765748 2.765748 2.765748 2.765748 0

2021-01-08 2.844769 2.844769 2.844769 2.844769 5000

Price Close High Low Open Volume

Ticker MDLZ MDLZ MDLZ MDLZ MDLZ

Date

2021-01-04 52.686432 54.578488 52.149747 53.204931 9187200

2021-01-05 52.741009 52.868358 52.140646 52.659141 5421900

2021-01-06 52.640957 53.059395 52.449933 52.750116 7663200

2021-01-07 52.540890 53.077578 52.167937 52.504507 8589100

2021-01-08 52.932041 53.004814 52.149752 52.186135 6642700

checking for dupes

print(smg_data.isnull().sum())

print(jbf_data.isnull().sum())

print(uvr_data.isnull().sum())

print(delm_data.isnull().sum())type(smg_data) #I just like to check what type of data we are working withchecking excel file

path = 'fnbStocks.xlsx'

isExist = os.path.exists(path)

print(isExist)True

So there was an error making the excel and here you would see that the columns for our data frame has two values

display(smg_data)| Price | Close | High | Low | Open | Volume |

|---|---|---|---|---|---|

| Ticker | SMGBF | SMGBF | SMGBF | SMGBF | SMGBF |

| Date | |||||

| 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

| 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

| 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| ... | ... | ... | ... | ... | ... |

| 2023-12-22 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

| 2023-12-26 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

| 2023-12-27 | 1.880809 | 1.969900 | 1.880809 | 1.969900 | 3000 |

| 2023-12-28 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

| 2023-12-29 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

753 rows × 5 columns

display(smg_data.columns)MultiIndex([( 'Close', 'SMGBF'),

( 'High', 'SMGBF'),

( 'Low', 'SMGBF'),

( 'Open', 'SMGBF'),

('Volume', 'SMGBF')],

names=['Price', 'Ticker'])

reassigned every dataframe with a new column

smg_data.columns= [col[0] for col in smg_data.columns]

jbf_data.columns=[col[0] for col in jbf_data.columns]

uvr_data.columns=[col[0] for col in uvr_data.columns]

delm_data.columns=[col[0] for col in delm_data.columns]display(smg_data.columns)Index(['Close', 'High', 'Low', 'Open', 'Volume'], dtype='object')

display(smg_data)| Close | High | Low | Open | Volume | |

|---|---|---|---|---|---|

| Date | |||||

| 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

| 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

| 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| ... | ... | ... | ... | ... | ... |

| 2023-12-22 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

| 2023-12-26 | 1.920405 | 1.920405 | 1.920405 | 1.920405 | 0 |

| 2023-12-27 | 1.880809 | 1.969900 | 1.880809 | 1.969900 | 3000 |

| 2023-12-28 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

| 2023-12-29 | 1.880809 | 1.880809 | 1.880809 | 1.880809 | 0 |

753 rows × 5 columns

with pd.ExcelWriter('fnbStocks.xlsx') as writer:

smg_data.to_excel(writer, sheet_name='SanMiguel')

jbf_data.to_excel(writer, sheet_name='Jollibee')

uvr_data.to_excel(writer, sheet_name='Robina')

delm_data.to_excel(writer, sheet_name='DelMonte')check to see if your excel file is good.

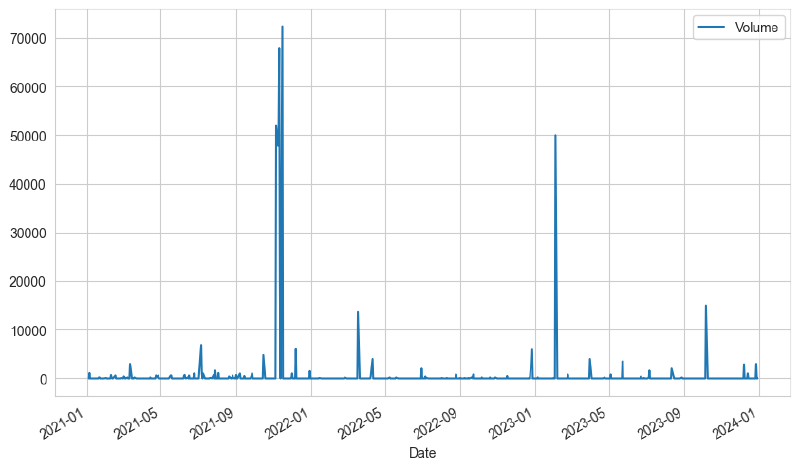

smg_data['Volume'].plot(legend=True,figsize=(10,6))

#historical view of volume for San Miguel Corp<Axes: xlabel='Date'>

Pivot a table from datetime

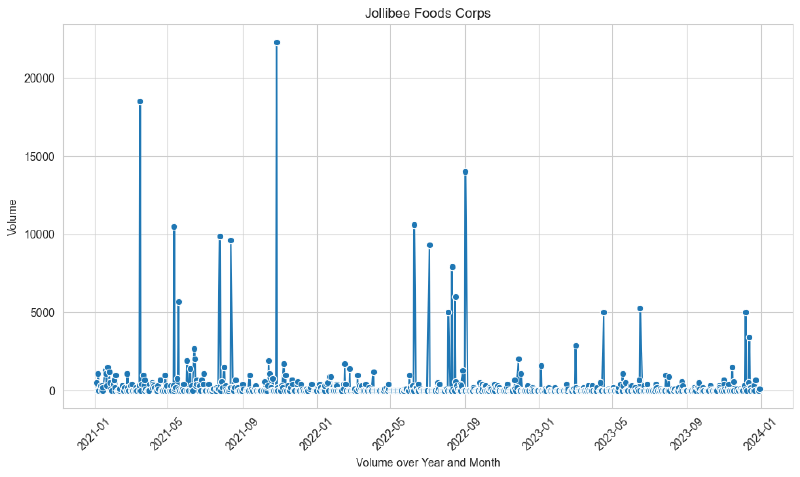

plt.figure(figsize=(10, 6))

sns.lineplot(x='Date', y='Volume', data=jbf_data, marker='o')

plt.xticks(rotation=45)

plt.title('Jollibee Foods Corps')

plt.xlabel('Volume over Year and Month')

plt.tight_layout()

plt.show()

historical view of volume for Jollibee

display(uvr_data)| Close | High | Low | Open | Volume | |

|---|---|---|---|---|---|

| Date | |||||

| 2021-01-04 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 2021-01-05 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 2021-01-06 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 2021-01-07 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 2021-01-08 | 2.844769 | 2.844769 | 2.844769 | 2.844769 | 5000 |

| ... | ... | ... | ... | ... | ... |

| 2023-12-22 | 1.870327 | 1.870327 | 1.870327 | 1.870327 | 0 |

| 2023-12-26 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 7600 |

| 2023-12-27 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

| 2023-12-28 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

| 2023-12-29 | 1.927875 | 1.927875 | 1.927875 | 1.927875 | 2500 |

753 rows × 5 columns

# Convert 'date_column' to datetime format

uvr_data = uvr_data.reset_index(drop=False)

display(uvr_data)| Date | Close | High | Low | Open | Volume | |

|---|---|---|---|---|---|---|

| 0 | 2021-01-04 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 1 | 2021-01-05 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 2 | 2021-01-06 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 3 | 2021-01-07 | 2.765748 | 2.765748 | 2.765748 | 2.765748 | 0 |

| 4 | 2021-01-08 | 2.844769 | 2.844769 | 2.844769 | 2.844769 | 5000 |

| ... | ... | ... | ... | ... | ... | ... |

| 748 | 2023-12-22 | 1.870327 | 1.870327 | 1.870327 | 1.870327 | 0 |

| 749 | 2023-12-26 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 7600 |

| 750 | 2023-12-27 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

| 751 | 2023-12-28 | 1.831961 | 1.831961 | 1.831961 | 1.831961 | 0 |

| 752 | 2023-12-29 | 1.927875 | 1.927875 | 1.927875 | 1.927875 | 2500 |

753 rows × 6 columns

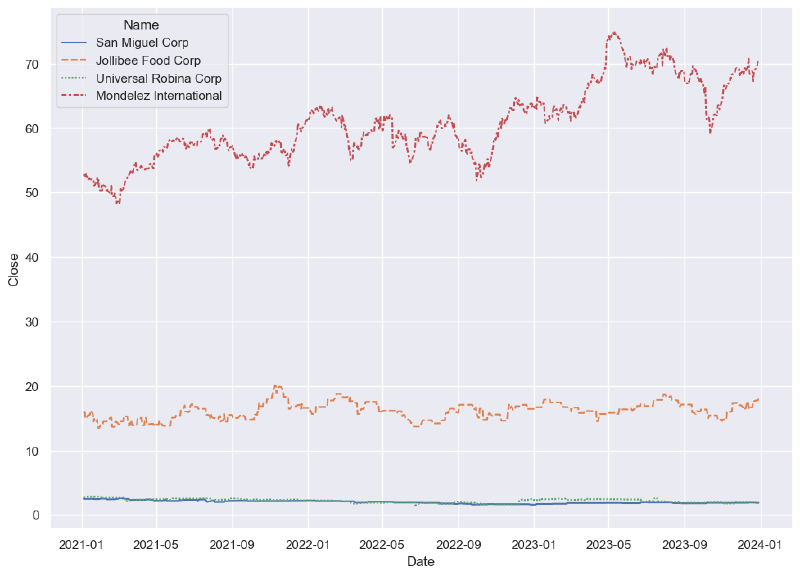

sns.set_theme(rc={'figure.figsize':(11.7,8.27)})

sns.lineplot(data=smg_data, x='Date', y='Close', label='San Miguel')

sns.lineplot(data=delm_data, x='Date', y='Close', label='Mondelez')

sns.lineplot(data=uvr_data, x='Date', y='Close', label='Robina')

sns.lineplot(data=jbf_data, x='Date', y='Close', label='Jabee')<Axes: xlabel='Date', ylabel='Close'>

historical comparison of Closing price of Stocks

smg_data = smg_data.reset_index(drop=False)

jbf_data = jbf_data.reset_index(drop=False)

delm_data = delm_data.reset_index(drop=False)smg_data.insert(0, 'Name', 'San Miguel Corp')

jbf_data.insert(0, 'Name', 'Jollibee Food Corp')

delm_data.insert(0, 'Name', 'Mondelez International')

uvr_data.insert(0, 'Name', 'Universal Robina Corp')

#adding a columns Name in the data frame# The comp stocks we'll use for this analysis

comp_list = [smg_data,jbf_data,uvr_data,delm_data]

#merging all the companies

comp_listGlobal = pd.concat(comp_list)display(comp_listGlobal)| Name | Date | Close | High | Low | Open | Volume | |

|---|---|---|---|---|---|---|---|

| 0 | San Miguel Corp | 2021-01-04 | 2.550820 | 2.550820 | 2.550820 | 2.550820 | 0 |

| 1 | San Miguel Corp | 2021-01-05 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 1100 |

| 2 | San Miguel Corp | 2021-01-06 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 3 | San Miguel Corp | 2021-01-07 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| 4 | San Miguel Corp | 2021-01-08 | 2.479167 | 2.479167 | 2.479167 | 2.479167 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 748 | Mondelez International | 2023-12-22 | 68.921280 | 69.269710 | 68.476065 | 68.553496 | 4109000 |

| 749 | Mondelez International | 2023-12-26 | 69.405212 | 69.589108 | 68.718033 | 68.911602 | 4002900 |

| 750 | Mondelez International | 2023-12-27 | 69.889145 | 69.937541 | 69.240681 | 69.463284 | 4061500 |

| 751 | Mondelez International | 2023-12-28 | 70.351608 | 70.439228 | 69.796662 | 69.884282 | 4095300 |

| 752 | Mondelez International | 2023-12-29 | 70.517113 | 70.731304 | 70.205564 | 70.234771 | 4658600 |

3012 rows × 7 columns

sns.lineplot(data=comp_listGlobal,x="Date", y="Close", hue="Name", style="Name")<Axes: xlabel='Date', ylabel='Close'>

This is a much simple code of historical comparison of Closing price of Stocks

#pivot a new data frame here

CloseDF = comp_listGlobal.pivot(index='Date', columns='Name', values=['Close'])

display(CloseDF)| Close | ||||

|---|---|---|---|---|

| Name | Jollibee Food Corp | Mondelez International | San Miguel Corp | Universal Robina Corp |

| Date | ||||

| 2021-01-04 | 15.941961 | 52.686432 | 2.550820 | 2.765748 |

| 2021-01-05 | 15.941961 | 52.741009 | 2.479167 | 2.765748 |

| 2021-01-06 | 15.941961 | 52.640957 | 2.479167 | 2.765748 |

| 2021-01-07 | 14.946193 | 52.540890 | 2.479167 | 2.765748 |

| 2021-01-08 | 14.946193 | 52.932041 | 2.479167 | 2.844769 |

| ... | ... | ... | ... | ... |

| 2023-12-22 | 17.654762 | 68.921280 | 1.920405 | 1.870327 |

| 2023-12-26 | 17.764172 | 69.405212 | 1.920405 | 1.831961 |

| 2023-12-27 | 17.764172 | 69.889145 | 1.880809 | 1.831961 |

| 2023-12-28 | 17.764172 | 70.351608 | 1.880809 | 1.831961 |

| 2023-12-29 | 18.291327 | 70.517113 | 1.880809 | 1.927875 |

753 rows × 4 columns

# Calculate the daily return percent of all stocks and store them

comp_returns = CloseDF.pct_change()display(comp_returns)| Close | ||||

|---|---|---|---|---|

| Name | Jollibee Food Corp | Mondelez International | San Miguel Corp | Universal Robina Corp |

| Date | ||||

| 2021-01-04 | NaN | NaN | NaN | NaN |

| 2021-01-05 | 0.000000 | 0.001036 | -0.028090 | 0.000000 |

| 2021-01-06 | 0.000000 | -0.001897 | 0.000000 | 0.000000 |

| 2021-01-07 | -0.062462 | -0.001901 | 0.000000 | 0.000000 |

| 2021-01-08 | 0.000000 | 0.007445 | 0.000000 | 0.028571 |

| ... | ... | ... | ... | ... |

| 2023-12-22 | 0.018944 | 0.010644 | 0.000000 | 0.000000 |

| 2023-12-26 | 0.006197 | 0.007022 | 0.000000 | -0.020513 |

| 2023-12-27 | 0.000000 | 0.006973 | -0.020619 | 0.000000 |

| 2023-12-28 | 0.000000 | 0.006617 | 0.000000 | 0.000000 |

| 2023-12-29 | 0.029675 | 0.002353 | 0.000000 | 0.052356 |

753 rows × 4 columns

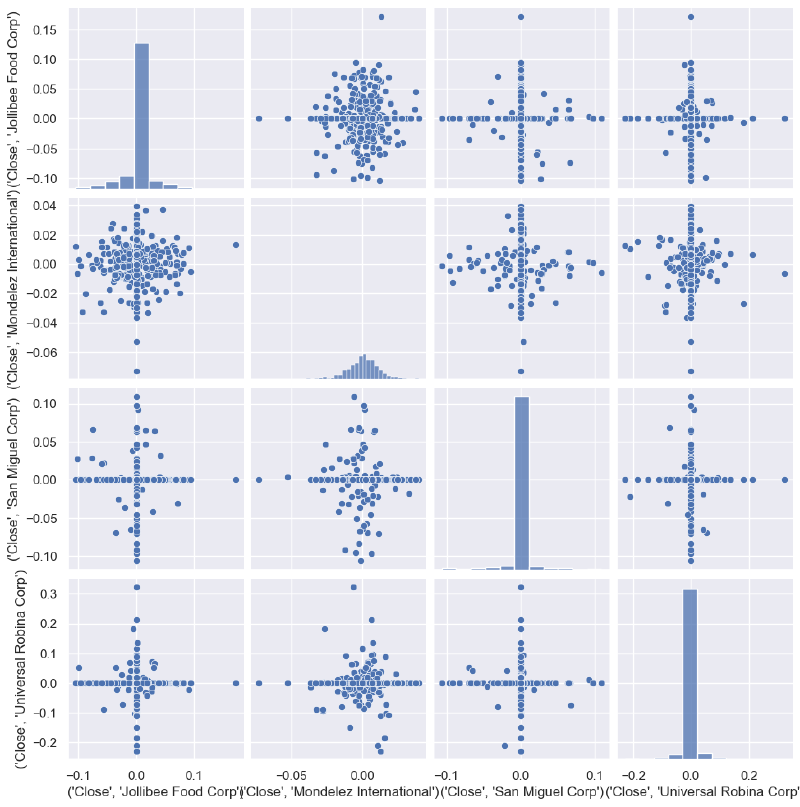

sns.pairplot(comp_returns.dropna())

#correlation analysis for all possible pairs of stocks in our food stock ticker list.<seaborn.axisgrid.PairGrid at 0x1e5652c4500>

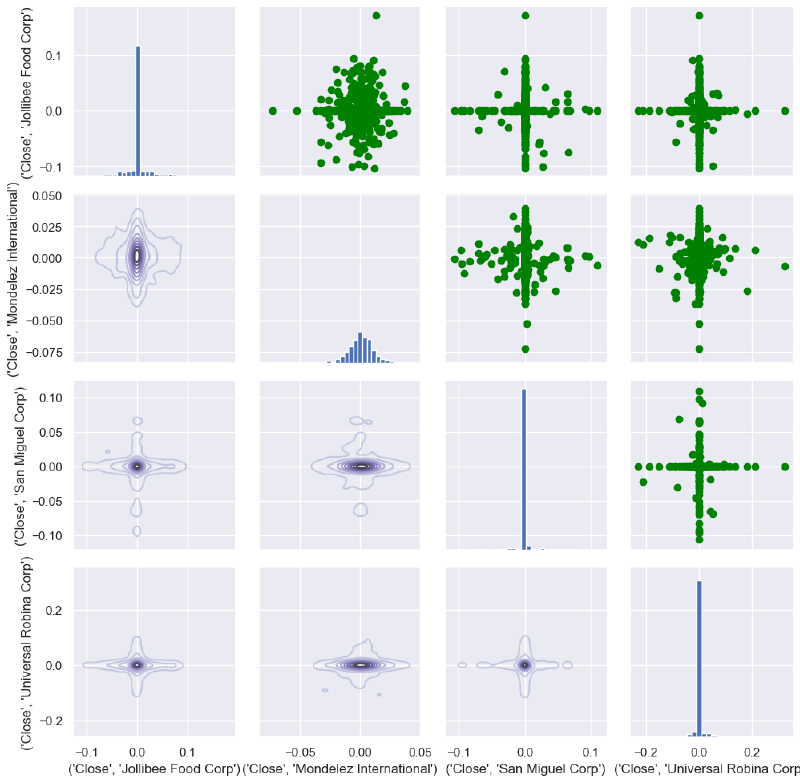

# Mixed plot to visualize the correlation between all food stocks

comp_fig = sns.PairGrid(comp_returns.dropna())

comp_fig.map_upper(plt.scatter,color='green')

comp_fig.map_lower(sns.kdeplot,cmap='Purples_d')

comp_fig.map_diag(plt.hist,bins=30)<seaborn.axisgrid.PairGrid at 0x1e56934adb0>

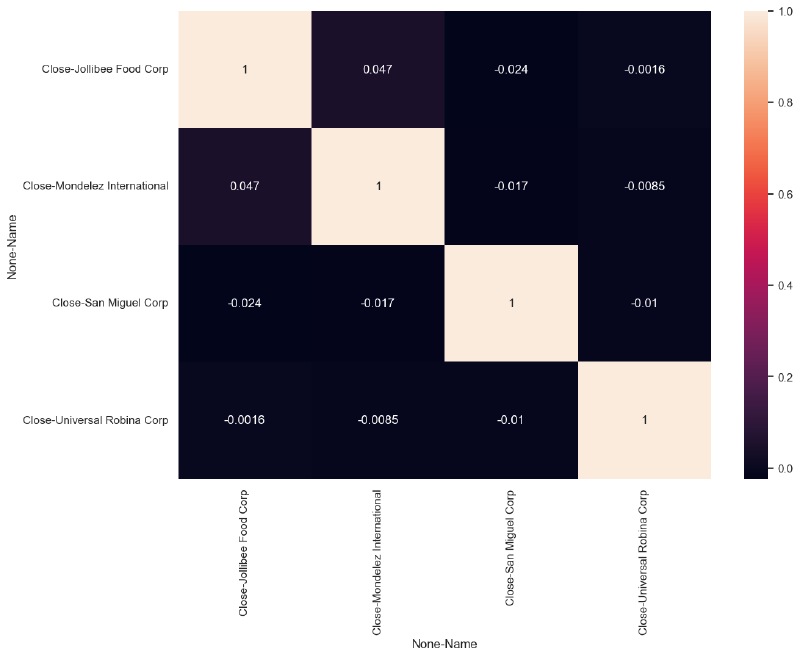

# Correlation plot for the daily returns of all stocks

comp_returns_corr= comp_returns.dropna().corr()

sns.heatmap(comp_returns_corr,annot=True)<Axes: xlabel='None-Name', ylabel='None-Name'>